Turning a life of shared values, bold choices, and endless curiosity into a global movement for impact.

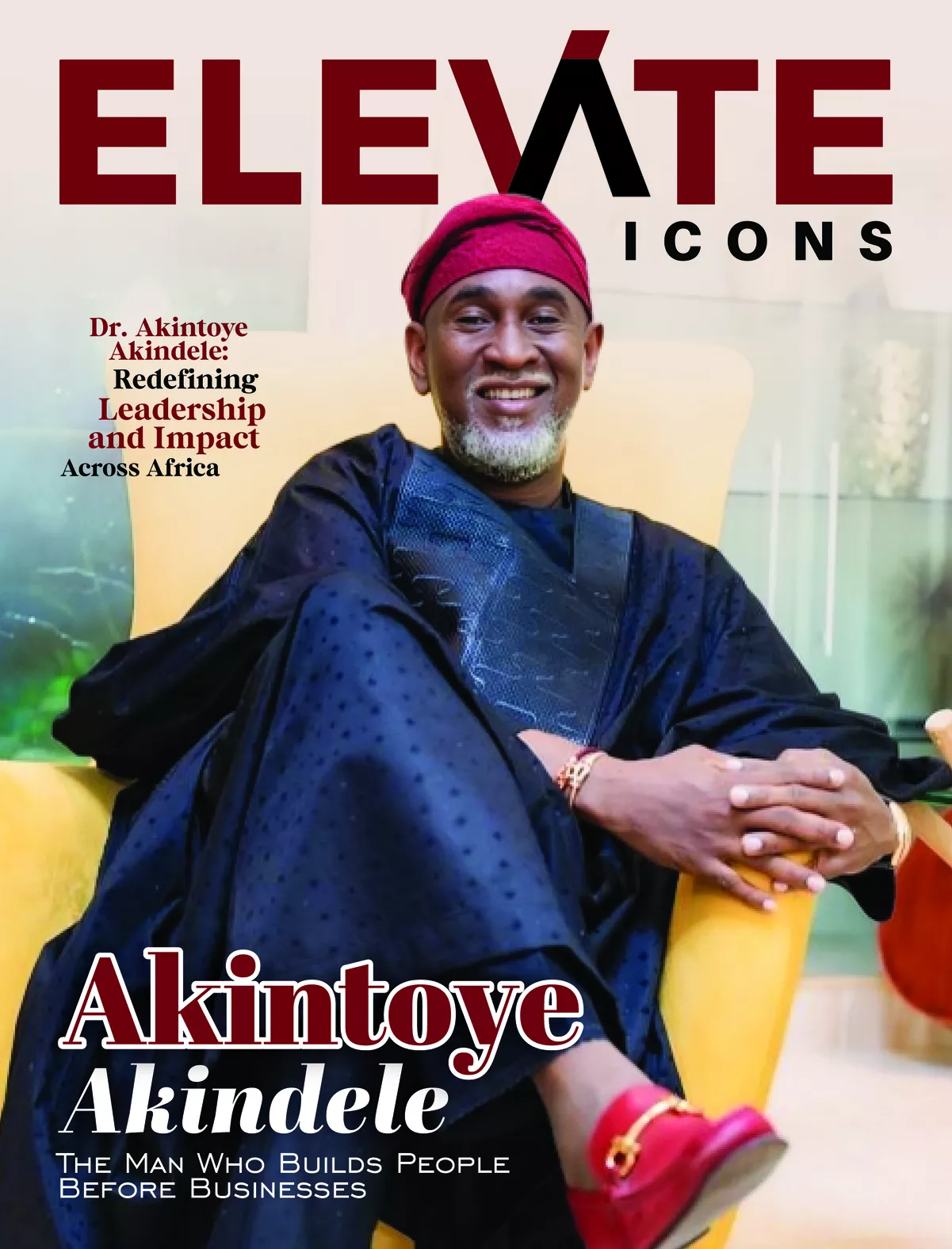

Across many industries today, people talk about impact, long term value, and purpose. These ideas fill conference halls and strategy decks. Yet for some leaders, these ideas were never trends. They were a way of living long before anyone gave them names. Dr. Akintoye Akindele is one of those leaders. His story began in a home where generosity guided everyone’s daily rhythm. His parents built a life where service was the natural language of leadership.

Meals were shared with fifty or more people every day. Children from the community lived with them. His mother cooked for many, and she still does. His father built boreholes and even a central mosque so people could pray with dignity. He sponsored children through school and made sure no one felt excluded because of faith, class, or background. The message was simple. Every life matters. Every person carries value. Service gives life meaning.

This atmosphere shaped the way he saw himself. It shaped the way he understood leadership. It shaped his belief that hard work, kindness, and community can lift entire generations. It also shaped his early understanding that impact is wealth in its purest form.

A Mind Built From Many Worlds

Engineering, on the surface, feels far from finance. Finance feels far from entrepreneurship. Technology feels far from social impact. Yet Dr. Akindele draws energy from all of these worlds, and his journey shows why.

He studied chemical engineering in university, even though most of his peers chased careers in banking. He wanted to build systems that could move society forward. When he started working as a process engineer at the Nigerian National Petroleum Corporation, he saw something that changed the way he thought about development. Every project required capital. Every idea required funding. Vision alone was never enough. Execution needed fuel.

This led him into banking. At Guaranty Trust Bank, he found an environment that reminded him of home. Leaders believed in people. They believed in preparing young minds for the future. He spent six months learning finance, corporate law, economics, strategy, and much more. He even completed a Frankly Covey leadership course at a time when such training was rare. The bank invested heavily in talent and shaped many future industry leaders.

While learning finance, he began studying technology. He took Microsoft and other technical certifications. He was still an engineer by training, but he now understood risk, capital, systems, and strategy. He had started seeing the world as one big network of connected problems and solutions.

He later worked in the conglomerate and multinational desk of the bank. This gave him a front row seat to how large companies make decisions, deploy capital, move funds across borders, grow talent, and shape entire industries. He learned how the best leaders think and how the strongest institutions stay strong.

Then he moved into telecoms and technology investment banking. Nigeria had just returned to democracy. Global investors were watching the country with interest. He became part of many deals that shaped the early years of the sector. He later became a CFA Charter Holder and gained deeper knowledge in debt, bonds, commercial papers, and all forms of financing.

But something else happened. After years in debt markets, he wanted to understand equity. He wanted to learn how companies grow, survive, and transform over long periods. So he joined African Capital Alliance, a leading private equity firm. He worked across telecoms, power, oil and gas, and many other sectors. He learned how to support entrepreneurs, manage investors, shape value, exit investments, and create long-term returns.

By the end of that chapter, he had completed more than one hundred transactions in his career. He had seen many sides of the economy. He had invested in companies that drew from his engineering, finance, and technology knowledge. He was ready for something bigger.

Stepping Into the Arena

Dr. Akindele created Synergy Capital in 2006, a boutique investment house that handled investment banking, advisory, restructuring, turnarounds, fiduciary services, and principal investments. He wanted an institution with the flexibility to serve any company across any industry. Many businesses in Africa needed more than capital. They needed guidance, systems, talent, and a partner that understood the long view. Synergy Capital delivered.

The firm took companies from startup to IPO. It restructured older companies and took them public, too. It raised funds and attracted global investors like IFC, CDC, and many others. During this period, he completed his PhD in Finance, focusing on emerging markets and investment theories that explained the work he had lived in practice.

Synergy Capital grew well. Yet he felt something pulling his attention. Private equity was powerful, but its time horizon was short. Many businesses in Africa needed patience. They needed space to grow without pressure. They needed capital that allowed transformation to happen at the right pace. They also needed freedom across sectors. Many investors avoided entire industries because they were “too early” or “too difficult.” He saw an opportunity there.

So he created Platform Capital.

A Platform Built on People

Platform Capital was built on a simple idea: success must include everyone. Growth must reach the bottom of the economic pyramid. Capital must walk side by side with impact. Every investment must lift lives, build value, and stay long enough for real change.

With Platform Capital, Dr. Akindele invested across stage, sector, and geography. He mixed local and global knowledge. He matched new entrepreneurs with large companies so they could learn from one another. He created an ecosystem where ideas, talent, and solutions could travel easily across regions.

The results were bold. In seven years, the firm completed around one hundred sixty investments. The balance sheet grew fifty times. Impact reached more than one million lives and kept rising. Entrepreneurs across Africa, North America, Asia, and Latin America found a place where collaboration felt natural. They exchanged ideas, shared solutions, and built joint ventures that reshaped industries.

The firm also invested in its own businesses. Cash flows from those businesses became capital for new investments. This gave Platform Capital independence. It attracted co-investors who trusted the firm’s long-term view and deep local understanding.

All of this worked because his leadership philosophy stayed simple. Keep the structure flat so every voice has space. Bring together different ages, cultures, and nationalities. Give people ownership. Platform Capital is 97% owned by its team. Everyone carries the mission together. Everyone feels the impact firsthand.

The firm also follows its core values called BLACK:

- Brother’s Keeper.

- Loyalty

- Authenticity

- Capacity.

- Knowledge.

These values guide every decision, every partnership, and every investment.

The Meaning of Patient Accretive Capital

Dr. Akindele believes in long-term value. He believes in building companies that can stand for decades. He often compares it to planting a seed. Growth takes time. Compounding takes time. Vision takes time. Patient accretive capital creates this timeline.

He looks at a company and asks where it can be in fifteen years. He designs systems, partnerships, policies, and teams that can carry that vision through different seasons. He frees businesses from election cycles. He creates space for entrepreneurs to learn, adjust, and keep going. This long view leads to strength. It leads to resilience. It leads to an impact that can be felt deeply.

Impact as a Way of Life

Impact for him is never an afterthought. It is the reason for the work. Alongside Platform Capital, he created the Diatom Impact Foundation, the foundation that channels most of the firm’s profits into social projects.

Thousands of lives have been touched through hospitals in rural communities, clean water systems, orphanage support, schools, widow empowerment, and many more. One of the most striking projects is the first prison incubation center in the world. Inmates learn coding, design, graphics, and other digital skills, allowing them to earn money and rebuild their lives even before release.

Another project supports young girls through a reusable sanitary pad innovation developed by a Platform Capital portfolio company. Girls across Africa and women in correctional facilities receive products that can last for two years. This solves hygiene challenges and restores dignity.

His partnership with the Nigerian Medical Association also brought psychiatric support to prisons that had only one psychiatrist nationwide at the time. His vision is to reach ten million lives over the next five years.

A Teacher At Heart

Dr. Akindele’s work travels across continents, yet he still teaches. He lectures in Nigeria and France, shaping young minds with stories, lessons, and examples from real life. He mentors, coaches, and guides emerging leaders.

For him, balance is never a question. He says success is love. When a person loves what they do, everything flows. Sacrifice becomes a natural part of building a meaningful life.

Why Knowledge Matters More Than Titles

His view on education is simple. School is useful, but knowledge lives everywhere. A carpenter, a fashion stylist, a musician, or a makeup artist all carry deep knowledge without formal degrees. Vocational learning, street learning, mentoring, and practice all carry value.

This is why he supports both education and skill training. He invests in young people learning coding at age eight, children from poor homes learning technology after school, and young adults learning new trades. Every skill matters. Every talent counts.

Building Bridges Across the World

As a goodwill ambassador of Georgia in the United States and a board member of the Africa-Asia Chamber of Commerce, Dr. Akindele helps create bridges between Africa and the world. He corrects narratives, creates partnerships, opens markets, and brings global investors closer to African entrepreneurs.

He is passionate about Asia–Africa collaboration, Latin America–Africa collaboration, and building networks that can carry the next century of growth. He believes Africa will heal the world. Africa has the youngest population, the deepest creativity, and the widest set of opportunities. He sees a continent rising with confidence.

A Love Affair With Failure

Dr. Akindele wrote a book called A Love Affair With Failure. It carries lessons from decades of trying, falling, rising, and learning. He believes failure is progress. Each attempt reveals a new way forward. He says success requires total commitment and total sacrifice. He remembers the years he walked through New York and London seeking investment, hearing many “no’s,” yet refusing to give up. He raised one of Nigeria’s first $100 million funds because he kept going.

He compares failure to pulling an arrow. The farther it pulls back, the farther it will fly. Setbacks prepare people for comebacks. Every try matters. Every effort counts.

The Message He Gives to the Next Generation

Dr. Akindele believes the future belongs to Africa’s young people. He believes the next five centuries can be theirs. He encourages them to learn, build skills, stay curious, embrace partnerships, value themselves, and keep moving forward. He wants them to shape the world they want to live in.